Volos Indexes for Hedging Equity Tail Risk

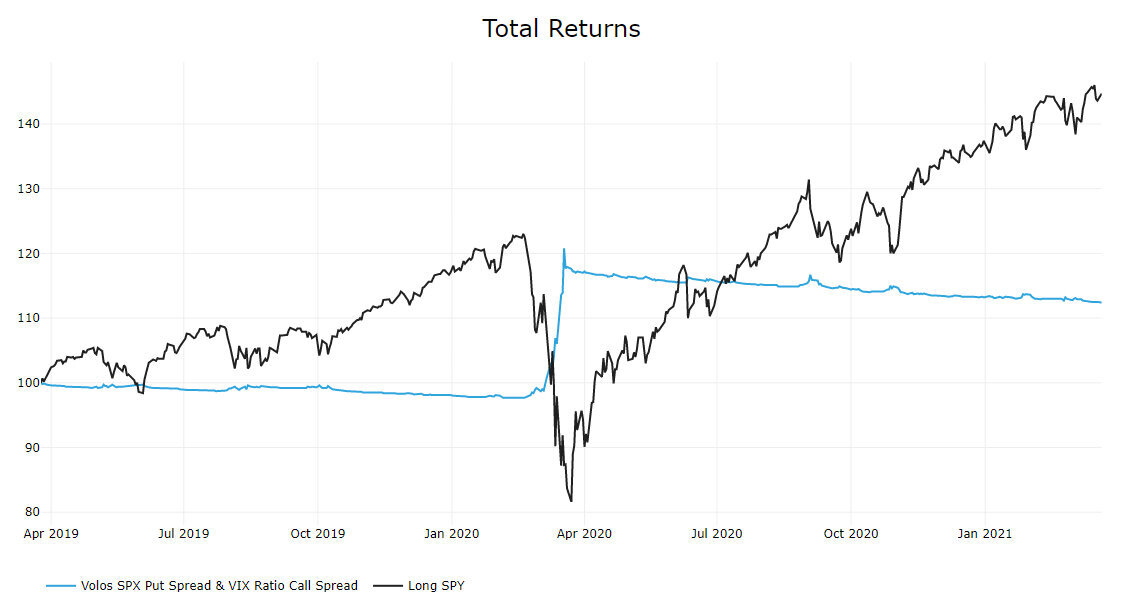

Introducing options-strategy indexes for tail hedging, designed to serve as a potential overlay for efficient equity downside protection.

Robust, Defined-Risk Hedging

This strategy was constructed using both SPX and VIX options in order to target returns in both down-trend markets with stable volatility (such as Q4, 2018) and tail events with elevated volatility (such as March, 2020).

Primary Index Rules

Consists of two hedge positions:

SPX Put Spreads

25 & 15 delta

75% of Hedge Notional

VIX 1x2 Call Ratio Spreads

50 & 35 delta

25% of Hedge Notional

Positions are entered with two months to maturity and rolled after one month. Hedge notional is equal to 30% of NAV.

Targeting High Convexity & Low Cost of Carry

SPX Long Put Spreads and VIX Short Ratio Call spreads provide (1) positive convexity, (2) defined risk, and (3) asymmetric short beta exposure.

Access

Clients can directly access data & documentation on this strategy through the Volos Index Platform, which provides unprecedented analysis and transparency on options-based Indexes.

About Volos

Volos provides financial Indexes and technology for institutional investors.

We specialize in indexes for options and derivatives strategies, providing transparency to this traditionally opaque asset class.

For additional information on Index licensing and services, please contact licensing@volossoftware.com.