Short Put Spreads as an Alternative to High-Yield Debt

Today we explore whether volatility strategies focused on income generation have become viable fixed income alternatives in today's environment.

We find it plausible in a post-COVID economy that heightened volatility in the markets will remain a persistent trend and that the most highly levered companies have become increasingly fragile as they were forced to raise even more debt during the pandemic. Both of these conditions justify a deeper analysis of whether volatility strategies focused on income generation have become viable fixed income alternatives.

Volos SPY Short Put Spread 95-105 Monthly Index

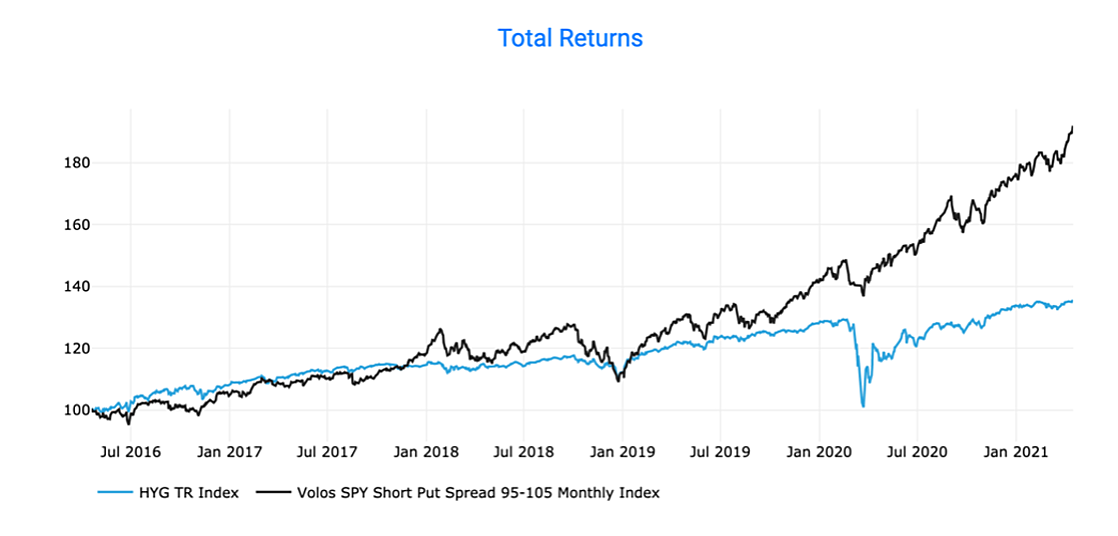

To perform this study we compared the total returns of iShares iBoxx $ High Yield Corporate Bond ETF (HYG) versus the Volos SPY Short Put Spread 95-105 Monthly Index over a trailing 5-year period. The results show that the Volos Index outperforms HYG (13.2% annualized returns vs. 6.7%) and does so with a minimal increase in volatility (10.1% annualized volatility vs. 9%). Other Volos Short Put Spread Indexes that reference equity ETFs such as EEM, EFA, IWM, and QQQ also outperformed over this period (see here).

While the Volos SPY Short Put Spread 95-105 Monthly Index did experience larger drawdowns than HYG, we note the astounding outperformance of the Index versus HYG during the COVID induced panic. With corporate balance sheets more highly levered than ever before, we wonder whether:

The strong outperformance of the Volos Short Put Spread 95-105 Index versus HYG is not an aberration and that sharp corrections will become more prevalent compared to a traditional bear market.

Investors should accept outsized drawdowns during market oscillations in exchange for higher returns and lower max drawdowns during tail events.

Volos ETF Short Put Spread Monthly Index Family

Volos provides 24 Short Put Spread Monthly Indexes focusing on the 8 most popular Asset Allocation ETFs for investors to evaluate and benchmark against. Explore all the Volos ETF Short Put Spread Monthly Indexes today by clicking below.

About Volos

Volos provides financial Indexes and technology for institutional investors.

We specialize in indexes for options and derivatives strategies, providing transparency to this traditionally opaque asset class.

For additional information on Index licensing and services, please contact licensing@volossoftware.com.