Public Indexes

Volos ETF Overlay Index Family

The Volos ETF Overlay Index Family is the result of a rigorous R&D process to create the foundation for an innovative suite of strategy indexes that are:

Simple

Based on liquid, exchange-listed ETF options.

Transparent

Easily accessible Index information, time-series data and constituents via the Volos Index Platform and API.

Modular

Select an asset class and overlay strategy based on primary investment objectives (i.e. downside protection, yield enhancement, etc.).

Standardized

Consistent index construction across strategies.

120 Overlay Indexes

8 Industry Leading ETFs

US Equities

International Equities

US Fixed Income

Commodities

5 Popular Strategies

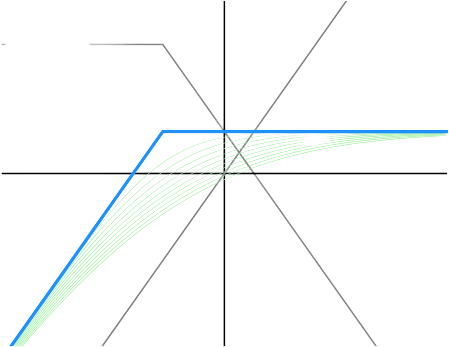

Volos ETF Covered Call Monthly Indexes

Each Index in the Volos ETF Covered Call Monthly Index Family tracks the performance of a systematic rolling Covered Call strategy (also known as "overwriting" or "buy-write") on a major ETF. The strategy consists of (1) a long ETF position and (2) a short call option on that ETF, that is rolled monthly.

Covered Call strategies are designed to generate income from the short call option and to provide exposure to the underlying up to the exercise price of the short call option, however, the short call option might cap the performance of the strategy.

A Volos ETF Covered Call Monthly Index might be useful for investors who think the ETF may increase moderately, but it will underperform a long position in the ETF during months of strong positive performance.

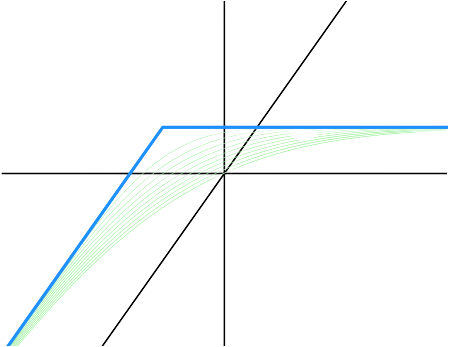

Volos ETF PutWrite Monthly Indexes

Each Index in the Volos ETF PutWrite Monthly Index Family tracks the performance of a systematic rolling PutWrite strategy (also known as "underwriting" or "short-puts") on a major ETF. The strategy consists of a short put option on that ETF, that is rolled monthly.

PutWrite strategies are designed to generate income from the short put option and to provide exposure to the underlying up to the exercise price of the short put option, however, the short put option might cap the performance of the strategy. They have a similar payoff structure to Covered Call strategies, but without a long underlying exposure. PutWrite strategies can also serve as a tactical method for entering long positions.

A Volos ETF PutWrite Monthly Index might be useful for investors who think the ETF may increase moderately over the month, but it will underperform a long position in the ETF during months of strong positive performance.

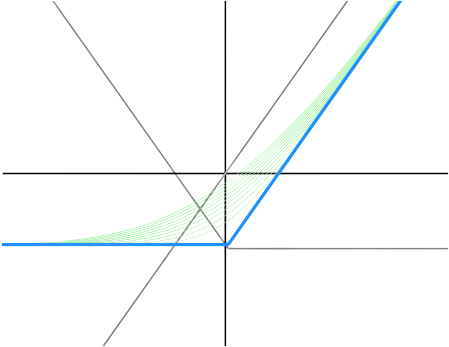

Volos ETF Protective Put Monthly Indexes

Each Index in the Volos ETF Protective Put Monthly Index Family tracks the performance of a systematic rolling Protective Put strategy on a major ETF. The strategy consists of (1) a long ETF position and a (2) a long put option on that ETF, that is rolled monthly.

Protective Put strategies are used as risk-management strategies designed to provide downside protection, from the long put option, while maintaining the upside potential to the underlying. A protective put acts like an insurance policy, protecting against large price drops, but the cost of the put will cap the performance of the strategy.

A Volos ETF Protective Put Monthly Index might be useful for investors who is bullish on the ETF but want to protect against large losses. However, the cost of the long put options will cause the strategy to underperform a long position in the ETF during months of positive performance.

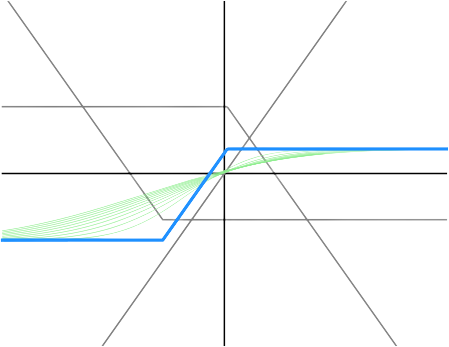

Volos ETF Collar Monthly Indexes

Each Index in the Volos ETF Collar Monthly Index Family tracks the performance of a systematic rolling Collar strategy (also known as "protective collars") on a major ETF. The strategy consists of (1) a long ETF position, (2) a long put option, with a lower exercise price, and (3) a short call option, with a higher exercise price, both on that ETF, that are rolled monthly.

Collar strategies are designed to provide exposure to the underlying while the long put option protects against large losses. The short call option is used to either fully or partially finance the put option, however the short call option might also cap the performance of the strategy.

A Volos ETF Collar Monthly Index might be useful for investors who want to protect against losses at a "low cost" while retaining some upside potential, but will underperform a long position in the ETF during months of strong positive performance.

Volos ETF Short Put Spread Monthly Indexes

Each Index in the Volos ETF Short Put Spread Monthly Index Family tracks the performance of a systematic rolling Short Put Spread strategy (also known as "bull put spreads") on a major ETF. The strategy consists of (1) a long put option, with a lower exercise price, and (2) a short put option, with a higher exercise price, on that ETF, that are rolled monthly.

Short Put Spread strategies are designed to provide exposure to the underlying while the long put option, with the lower exercise price, protects against large losses. The short put option, with the higher exercise price, is used to either fully or partial finance the long put option, however the short put option might also cap the performance of the strategy. They have a similar payoff structure to Collar strategies, but without direct exposure to the underlying.

A Volos ETF Short Put Spread Monthly Index might be useful for investors who want to generate income, from the net premium of the put spread, and who thinks the ETF performance will be flat or may rise moderately, but will underperform a long position in the ETF during months of strong positive performance.

3 Structural Variations

5% Out of the Money

At the Money

5% In the Money

Protective Put overlay strategy variations are at the money, 5% out of the money, and 10% out of the money.