Improving 0-DTE Trading Returns By Avoiding Expensive Exits

For our newest research paper, Volos analyzed historical intraday options pricing using Nasdaq-100® (NDX) index options to better understand transaction costs associated with 0-DTE options trading.

Specifically, we studied "bid-ask" spreads over different intraday time-weight average price (TWAP) windows associated with 0-DTE trading. We calculated the "Mid to Bid" spread, which seeks to quantify the potential spread an options trader may incur in excess of the options mid-price.

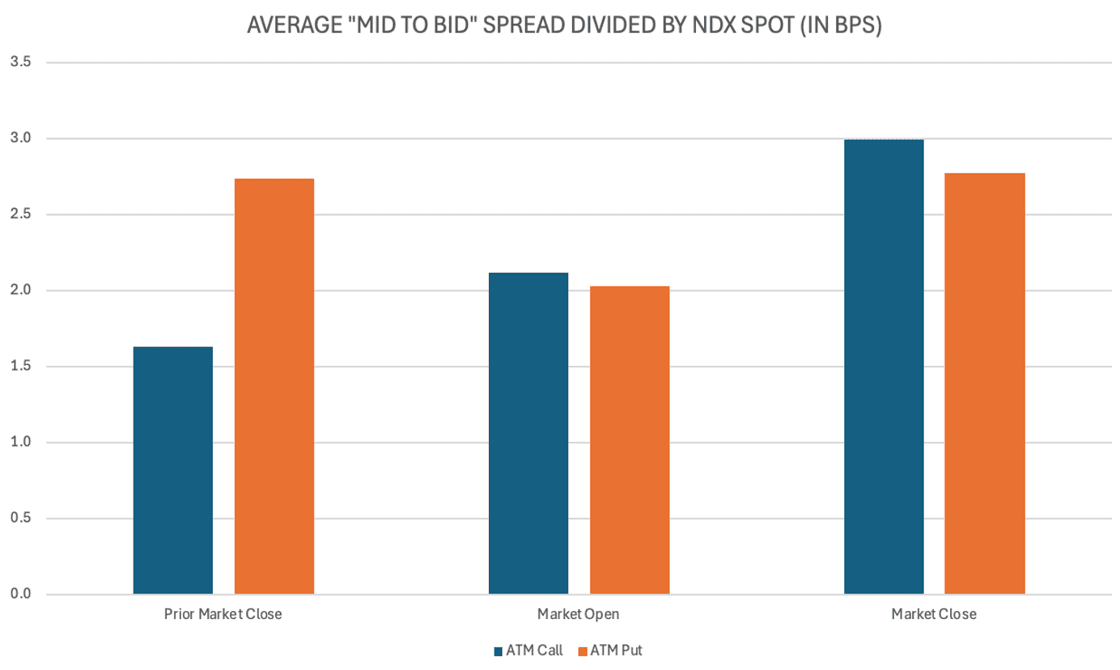

The figure above shows the average "Mid to Bid" spread (the difference between the bid and the mid price divided by NDX spot price) of 0-DTE at-the-money call and put options whose strike is selected at the prior trading day's market close. There are several notable observations including:

1. ATM put versus call options at the prior market close showed a historically high difference in spreads (~1 bps). These contracts are a popular entry point for 0-DTE options traders.

2. Spreads were highest on average when 0-DTE options were near expiration (at the market close). The higher average spreads have historically been driven by the high spreads observed in expiring in-the-money options (seen in the figure below).

Expiring ITM call or put options on average have had high spreads of ~6 bps, over double the average spread at the market close across our full sample. These high spreads, coupled with the fact that extrinsic option costs are near zero with an expiring ITM option, indicate that a trader might need to pay excess transaction fees in order to exit and roll into a new options position — meaning crossing the mid-price of the option to transact.

We quantified the annual costs to transact in 0-DTE options based on time of day and the daily returns of the Nasdaq-100 index in the figure below. Assuming a 25% slippage rate of the "Mid to Bid" spread, a trader historically has paid an average of 300-350 bps in annual transaction costs to both enter and exit daily NDX options. The cost to exit an expiring, ITM exceeds 350 bps alone.

Given the European-style and Cash Settlement features of index options, 0-DTE index options traders have the unique benefit of allowing expiring, ITM options to settle in cash rather than transact and pay high fees (also without carrying the same risks associated with an options' exercise compared to ETF and stock options). Letting ITM options expire and settle in cash would have historically reduced the trading costs associated with rolling out of expiring 0-DTE options by over 50%, which translates to over 85 bps of annual returns. For an options seller only capable of earning a finite amount of options premium each day (and on the losing end of an expiring, ITM options in these instances), these saved transaction costs may represent a material amount of their strategy's performance.

Transaction cost analysis is a standard output for every strategy modeled in Volos' options strategy development platform, the Volos Strategy Engine. As one of our institutional services, Volos collaborates with banks, hedge funds, pension funds, and insurers to enhance transparency and accuracy in transaction cost modeling within QIS. We do this by rebuilding these strategies within the Strategy Engine as an independent validation of a bank QIS methodology. We then decompose and analyze transaction costs using real-world historical pricing. This allows Volos (and the client) to independently corroborate that the fees modeled by the banks are reasonable and accurately reflect market conditions.

To learn more about Volos indexes, software, or our QIS validation service, schedule a call below: